Maximum 401k Contribution 2025 Over 50

Maximum 401k Contribution 2025 Over 50. Employer matches don’t count toward this limit and can be quite generous. So, workers age 50 and up can contribute a maximum of $30,500 to their roth 401 (k) in 2025.

Employers can contribute to employee. For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you’re 50 or older.

Max 401k Contribution With Catch Up 2025 Alia Louise, In 2025, this rises to $22,500. Savers will be able to contribute as much.

Over 50 Catch Up 401k 2025 Jean Robbie, Employers can contribute to employee. For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older.

What Is The Maximum 401k Contribution For 2025 Erica Ranique, For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older. There are a few different ways employers can match an employee’s 401 (k) contribution.

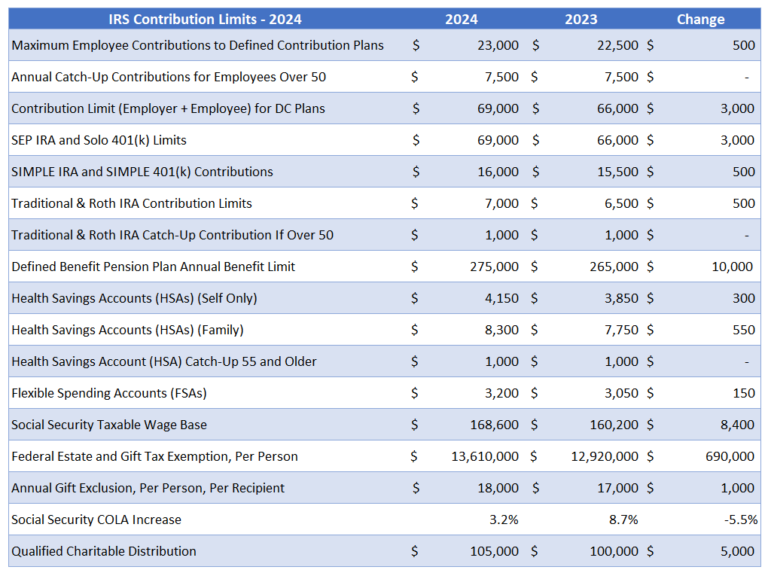

2025 Irs Maximum 401k Paige Loleta, How much can you contribute to a 401 (k) retirement account in 2025 vs. For 2025, the solo 401(k) maximum contribution limit for the elective deferral is $23,000 if you’re age 50 and under.

401k 2025 Contribution Limit Chart, For 2025, the solo 401(k) maximum contribution limit for the elective deferral is $23,000 if you’re age 50 and under. Employers can contribute to employee.

Annual 401k Contribution 2025 gnni harmony, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. In 2025, this rises to $22,500.

2025 Max 401k Contribution Employer And Employee Harli Gertruda, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. The income thresholds to be eligible.

Annual 401k Contribution 2025 gnni harmony, Irs releases the qualified retirement plan limitations for 2025: Savers will be able to contribute as much.

2025 Traditional Ira Contribution Limits Over 50 Lia, The 401(k) contribution limit is $23,000. In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

2025 Ira Contribution Limits Over 50 Emelia, Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year. Employers can contribute to employee.

In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.